This post is the fifth in a seven-part series that uses a regulatory lens to explore how different dimensions of data quality can impact organizations—and how GX can help mitigate them. Read part 1 (schema), part 2 (missingness), part 3 (volume), and part 4 (distribution).

Ensuring the consistency and accuracy of individual datasets is already a challenge. Ensuring the consistency and accuracy of data relationships takes that challenge to the next level.

As data flows through your systems and undergoes transformations, merges, joins, and other processes, subtle inconsistencies can creep in. These small deviations snowball into major discrepancies, with far-reaching consequences from distorted analytics to compliance risks and eroded trust in the data.

Data integrity monitoring is how you can prevent these issues from spiraling out of control. When a financial report pulls customer and transaction data from half a dozen sources, data integrity ensures that the figures all line up. When a patient’s records are passed between providers, data integrity makes sure that lifesaving information doesn’t fall through the cracks.

For data teams, integrity has to be a top priority.

The ripple effect: How small inconsistencies lead to big problems

As regular readers of our series know, we’re illustrating the common challenges facing data teams using the story of FinTrust Bank, a fictional financial institution.

Samantha is the data team lead at FinTrust Bank, and her team has made significant strides in improving the organization’s data quality monitoring. But as trust in the data grows and outcomes improve, there’s increased demand for data across FinTrust Bank. And as data pipelines expand to meet this demand, subtle inconsistencies began to emerge.

Compounded across systems, these data integrity issues threatened to set back the progress that FinTrust Bank had made. It was critical that Samantha and her team get a handle on their data integrity challenges as soon as possible.

To create a strategic validation framework for data integrity, Samantha and her team drew on their experiences addressing other dimensions of data quality.

Charting the path to data integrity maturity

Ensuring data integrity can feel like a daunting task. But with a staged approach, you can systematically enhance your data integrity capabilities without overwhelming your team.

We recommend a three-stage maturity model:

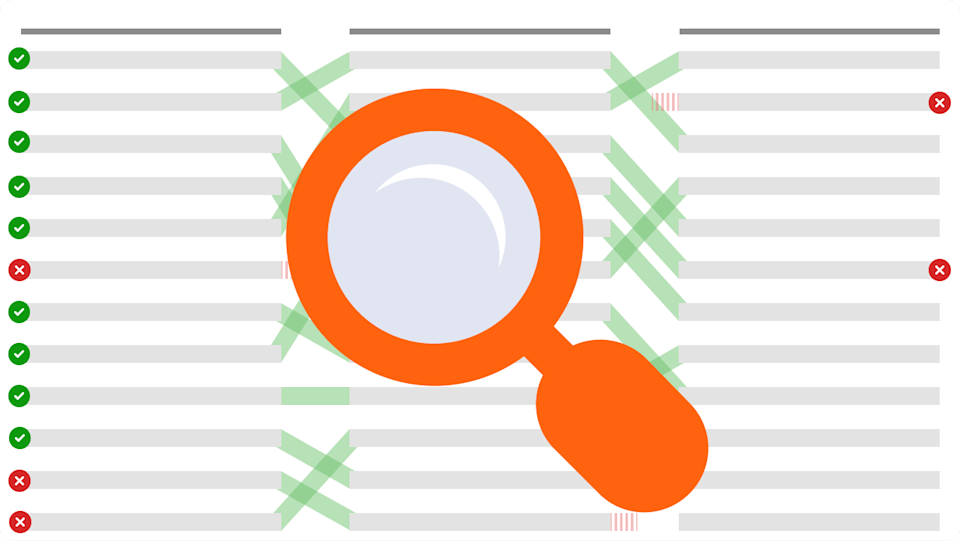

Basic validation: Start by focusing on the accuracy of individual data elements. Use built-in tools like GX Cloud’s Expectations to quickly create basic accuracy checks that you can run regularly—ideally, on an automated schedule.

Relationship consistency: Next, work on ensuring consistency across related datasets. Validate relationships between data elements in different tables or systems. In GX Cloud, you can pair the relevant integrity Expectations with a SQL view

Business rule alignment: Finally, align your data with your organization’s specific business rules and domain constraints to assure ongoing compliance. At this point, your validation rules are likely to be highly complex and specific to your organization, so you’ll need a tool that facilitates custom validation. In GX Cloud, you’ll likely use custom SQL Expectations for the majority of this work.

By progressing through these stages, you can systematically enhance your data integrity capabilities, moving from basic accuracy to comprehensive consistency and business alignment. And with tools like GX Cloud, you can automate and scale these validations, embedding integrity checks into the very fabric of your data operations.

This approach allows teams to start simple and progressively add sophistication as their needs evolve. For technical guidance on implementing data integrity in GX, visit our documentation on data integrity.

Application: FinTrust Bank's journey to data integrity excellence

Faced with the mounting costs and risks of data integrity issues, Samantha and her team at FinTrust Bank knew they needed to act. They tackled the challenge head on, and began implementing a robust data integrity validation framework using GX Cloud.

The team started by assessing their current data integrity maturity level and identifying the most critical gaps. They then progressively enhanced their capabilities, following the three-stage maturity model:

They began by implementing basic accuracy checks on their customer data using GX Cloud's built-in Expectations (or verifying that these checks already existed from previous efforts). These validations included checking for uniqueness in custom IDs, format of phone numbers and email addresses, and population of required fields.

Next, they focused on ensuring consistency between their customer data and related account and transaction data, using GX Cloud's integrity Expectations in conjunction with a SQL view. One example: they validated that every customer ID in the accounts table had a corresponding entry in the customers table, and that transaction amounts aligned with the expected account balances.

Finally, they encoded FinTrust Bank's specific business rules and domain knowledge into their validation framework. For instance, they used custom SQL Expectations to verify that high-risk transactions over a certain threshold always had a manager approval flag, and that dormant accounts with no activity in the past year were properly labeled.

By leveraging GX Cloud's automated validation and continuous monitoring capabilities, they were able to identify and resolve data inconsistencies effectively, ensuring the accuracy and reliability of their data assets.

These efforts bore immediate results. Regulatory reports that once required days of manual reconciliation could now be generated with confidence in hours. Business leaders on different teams grew more confidence in collaborating across departments, allowing more informed decisions.

By prioritizing data integrity and proactively addressing challenges, FinTrust Bank not only mitigated risks but also unlocked new opportunities for innovation and growth.

Navigating pitfalls: Common data integrity implementation challenges

As Samantha and her team at FinTrust Bank discovered, implementing a robust data integrity validation framework is not without its challenges. They encountered several common pitfalls along the way.

System performance. As FinTrust Bank began to run more data integrity validations on their large datasets, they noticed significant slowdowns in their datapipelines. To address this, the data team carefully configured the frequency of validation runs based on the dataset’s volume, and used sample techniques where appropriate for initial validation of particularly large datasets.

Rule complexity. Data integrity rules and domain constraints became increasingly complex as data integrity validation spanned more and more tables. Samantha’s team found themselves grappling with unwieldy rules that had intricate requirements. To mitigate this, they broke down complex rules into smaller and more manageable components—and, critically, leveraged the built-in Expectations in GX Cloud whenever possible, avoiding unnecessary customization work.

Timing issues. When checking data relationships that spanned systems, differing data load times and latencies could cause false validation failures. FinTrust Bank’s data team needed to include time-based tolerances in the data integrity validations to account for these technical realities.

By proactively addressing these challenges, learning from their experiences, and being willing to iterate on their test framework, Samantha and her team were able to successfully navigate these pitfalls and unlock the true potential of data integrity validation.

Join the conversation

Data integrity is about more than individual data points: it’s about the relationships that bind them together. With a robust system of validation and monitoring, you can ensure that your data remains a wellspring of truth and trust, no matter how complex the landscape becomes.

Share your experiences and learn from other data practitioners in the GX community forum, and let's chart the course to data integrity excellence together.

Coming next: In our upcoming post on data uniqueness, we'll explore strategies for monitoring your data’s degree of distinctiveness.